UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by Registrantx☒

Filed by a Party other than the Registrant¨☐

Check the appropriate box:

Preliminary Proxy Statement |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Definitive Proxy Statement |

Definitive Additional Materials |

Soliciting Material Pursuant to §240.14a-12 |

BOSTON PROPERTIES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required. |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

Fee paid previously with preliminary materials. |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

April 3, 2020

Dear Fellow Stockholder:

On behalf of the Board of Directors, I am delighted to invite you to attend the 2020 Annual Meeting of Stockholders of Boston Properties, Inc., or BXP. The meeting will be held on Wednesday, May 20, 2020 at 9:00 a.m., Eastern Time, at Metropolitan Square, 655 15th Street, NW, 2nd Floor, Washington, DC 20005. However, as discussed in detail in the Notice of Meeting that follows this letter, depending on the status of theCOVID-19 pandemic, we may decide to hold the meeting “virtually.”

As I write this letter, we are quickly approaching the 50th anniversary of the founding of Boston Properties, Inc. and our 23rd year as a public company listed on the NYSE. In light of these milestones, I want to share with you some notable achievements in 2019, as well as highlight some key policy changes that we believe will enhance transparency and improve your understanding of Boston Properties’ affairs.

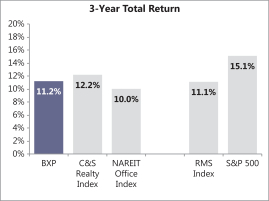

Boston Properties is certainly much larger and more complex today than at any time in its history, as we now operate in five regions on both U.S. coastlines and are developing premier buildings on a scale that is greater than ever before. Despite that growth, your Board is pleased to report that under the leadership of our CEO, Owen Thomas, and President, Doug Linde, the vision and strategy of our founders, Mort Zuckerman and the late Ed Linde, remain the foundation of what we do. That strategy has proven successful. An investment in BXP common stock on the date of our IPO has appreciated by more than 1,346% as of December 31, 2019, far surpassing the 456% return on an equal investment in the S&P 500 Index.

2019 Business Highlights

2019 was an excellent year for Boston Properties, particularly considering that it followed a very strong 2018. Our success is demonstrated by our financial results and other key accomplishments. While the accompanying proxy statement details your management team’s significant accomplishments in 2019, I want to highlight some that stand out and provide context for the discussion of the compensation of our named executive officers, or “NEOs”:

26% Total Stockholder Return for 2019 | 11% Y-o-Y Growth in Diluted FFO per Share1 | 9% Y-o-Y Increase in Cash Dividend, 42% over Past Three Years | 7.6 Million Square Feet Leased | |||

6.7% Y-o-Y Growth in Same Property NOI (BXP’s Share)1 | 5.4% Y-o-Y Growth in Same Property NOI – Cash (BXP’s Share)1 | $3.1 Billion BXP’s Share of Estimated Total Investment in Active Development Pipeline | 76% Pre-Leased Development Pipeline (excluding residential) | |||

|  |

|

Environmental, Social and Governance (ESG) Leadership

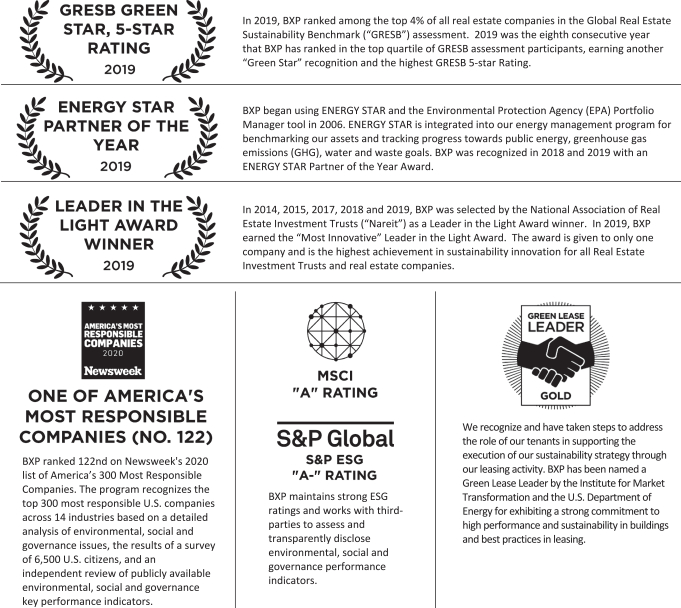

2019 was another strong year for BXP during which we made substantial progress and maintained our position as an industry leader on environmental, social and governance issues.

› Environmental. Our sustainability strategy is to conduct our business in a manner that contributes to positive economic, social and environmental outcomes for our customers, stockholders, employees and the communities we serve. Our experience demonstrates that through our activities, we can contribute to environmental solutions as a positive force while improving our financial performance and becoming a stronger, more purposeful organization in the process. We deliver efficient, healthy and productive workspaces while simultaneously mitigating operational costs and potential external impacts of energy, water, waste, and greenhouse gas emissions. We are also keenly focused on the climate resilience of our existing portfolio of assets, and we are preparing for long-term climate risks, such as extreme heat, severe storms and sea level rise, by considering climate change scenarios.

Your Board of Directors and CEO are committed to building a company culture in which the commitment to these tenets extends to every region in which we operate, every department and function, and every employee. As a result of these focused efforts, BXP won various industry and other awards in 2019, and we are recognized as a global industry leader in sustainability. Your Board is especially proud of these accomplishments because they are a direct result of our sustained commitment throughout the enterprise over several years. A list of these various awards is on page 5 of the accompanying proxy statement.

› Social. Boston Properties has an established reputation for excellence and integrity, and these core values are inherent in our culture; defining our strategy, achieving our business goals, and contributing to our overall success. Our teams are highly engaged with their local communities in determining how our projects can enhance neighborhoods, improve public amenities and provide high-quality space for working and living in order to positively impact the regions in which we operate. BXP and its employees also make a social impact through charitable giving and volunteerism.

Similarly, BXP is committed to providing an environment for its employees that fosters talent, energy and well-being. We seek an inclusive and diverse workforce that represents the communities we serve, and we design our programs to meet the needs of our workforce and support our employees and their families. The success of our efforts is demonstrated by the long tenure of our employees, nearly 40% of whom have worked at BXP for more than ten years.

› Governance. Your Board of Directors currently consists of eleven individuals with diverse backgrounds who are dedicated to serving the best interests of our stockholders. The accompanying proxy statement contains very detailed information on the composition of our Board and its responsibilities, including a snapshot of our policies on page 1 of the Proxy Summary.

Investor Outreach & Changes in Compensation Policies

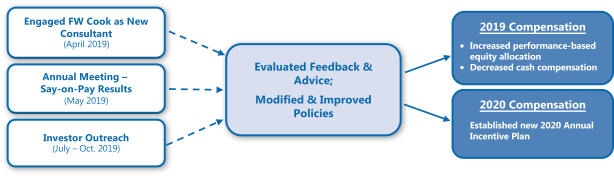

At our 2019 annual meeting, our stockholders approved the“Say-on-Pay” resolution to ratify the compensation we paid to our named executive officers. Although the core philosophy and design of our compensation program remained materially consistent with prior years, Institutional Shareholder Services recommended that its clients vote against our 2019Say-on-Pay resolution and the percentage of votes cast in favor of theSay-on-Pay resolution decreased from approximately 91% in 2018 to approximately 67% in 2019.

The results of the vote reflected approval of our executive compensation program as a whole, but the level of support was less than we expected and less than we desire. As a result, your independent directors, led by the Chair of the Compensation Committee and me, engaged directly with ten of our largest institutional investors representing ownership of more than 40% of the outstanding shares of BXP common stock to solicit feedback on our executive compensation program and our corporate governance policies generally and to better understand their individual concerns.

In addition to the feedback from investors, the Compensation Committee evaluated the advice received from its new independent consultant, Frederic W. Cook & Co., Inc. on the reasonableness of the Company’s executive compensation levels in comparison with those of other similarly situated companies and recommendations for the components and amounts of compensation paid to our top executive officers.

|  |

| ||||

|

|

April 1, 2016

Dear Stockholder:

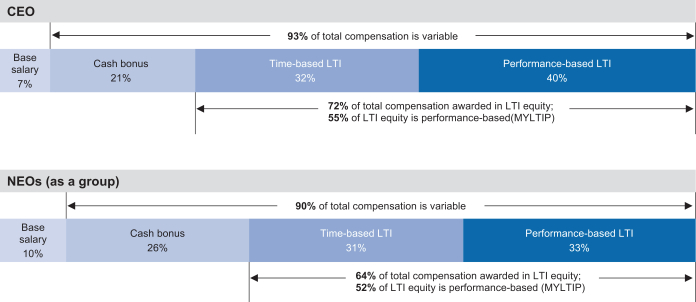

You are cordially invited› New Annual Cash Bonus Program – The Compensation Committee established a new 2020 Annual Incentive Plan. Under this plan, beginning in 2020, annual cash bonuses paid to attend the 2016 annual meeting of stockholders of Boston Properties, Inc. The annual meetingour executive officers will be helddirectly linked to their performance against goals in three, equally-weighted categories:

FFO per Share

Leasing

Business/Individual Goals

Some of our investors expressed a desire for more objectivity and structure in BXP’s annual cash bonus program, including specific weightings ascribed to each measure and transparent disclosure of goals and results. The new bonus plan addresses investors’ feedback on Tuesday, May 17, 2016 at 10:00 a.m., Eastern Time, at Lotte New York Palace Hotel, 455 Madison Avenue, 5th Floor, New York, New York.the discretionary nature of BXP’s traditional bonus program, reduces the number of performance goals and includes specific weightings for each measure.

› Target and Maximum Cash Bonus Opportunities – Beginning in 2020, all executive officers have target and maximum annual cash bonus opportunities. Amounts actually earned may range from zero (0) to 150% of target, depending on performance versus theirpre-established goals in each category. The proxy statement, withCompensation Committee incorporated the accompanying formal notice of the meeting, describes the matters expected to be acted upon at the meeting. We urge you to review these materials carefullytarget and to use this opportunity to take partmaximum bonus opportunities in the affairsnew bonus plan in response to investors expressing a preference for a clearly defined ranges of Boston Properties by voting onbonus opportunities.

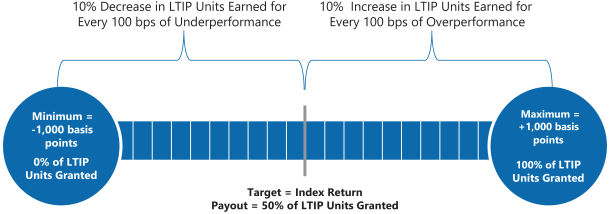

› Allocation to Performance-based Equity Awards – The Compensation Committee increased the matters describedpercentage of equity awards that are granted to our CEO in the proxy statement. Followingform of performance-based equity awards from 50% to 55%, so the formal portionallocation between performance-based and time-based equity awards is now55%-45%. (The allocation for all other NEOs remains50%-50%.) In addition, the Compensation Committee increased the allocation of total compensation to long-term equity compensation and decreased the meeting, we will reportallocation to short-term cash compensation to increase alignment with stockholders and focus on the operationslong-term performance. As a result, performance-based equity awards for all NEOs represent a greater percentage of our company and our directors and management team will be available to answer appropriate questions from stockholders.total direct compensation than they did in 2018.

Your vote is important. We hopetrust that you will beview these changes as a demonstration of the commitment of Boston Properties’ Board to engage with you and to proactively respond to your concerns.

*****

The accompanying proxy statement contains a great deal of other important information about Boston Properties, and we hope you will take the time to read it. Whether or not you are able to attend the meeting. Whether or not you plan to attend theannual meeting, please vote as soon as possible. Instructions on how to vote are containedwe welcome your participation in the proxy statement.

Thankour affairs and thank you for your continued support of Boston Properties.support.

Sincerely,

Mortimer B. Zuckerman

Joel I. Klein

Chairman of the Board

| 1 | For disclosures required by Regulation G, refer to (1) pages 95 through 97 of our 2019 Annual Report on Form10-K for FFO and diluted FFO per share and (2) Appendix A to the accompanying proxy statement for BXP’s Share of Same Property NOI and NOI – Cash. |

|

|

|

Notice of 2016 Annual Meeting of Stockholders

|

NOTICE OF 2020 ANNUAL

MEETING OF STOCKHOLDERS

DATE AND TIME | ||||

LOCATION | ||||

RECORD DATE | ||||

*Depending on the status of health concerns about the coronavirus, orCOVID-19, we may decide to hold the annual meeting by live audio webcast instead of holding the annual meeting in person at Metropolitan Square. The Company will publicly announce a decision to hold the annual meeting, at the same date and time, solely by audio webcast in a press release available athttp://investors.bxp.com/press-releases as soon as practicable before the annual meeting. In the event the annual meeting is not held at Metropolitan Square, you or your proxyholder may participate, vote and examine our stockholder list by visitingwww.virtualshareholdermeeting.com/BXP2020 and using your16-digit control number.

Since becoming a public company in 1997, we have always held our annual meetings in person, and it remains our intention to do so under normal circumstances.

ITEMS OF BUSINESS

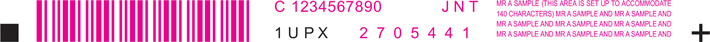

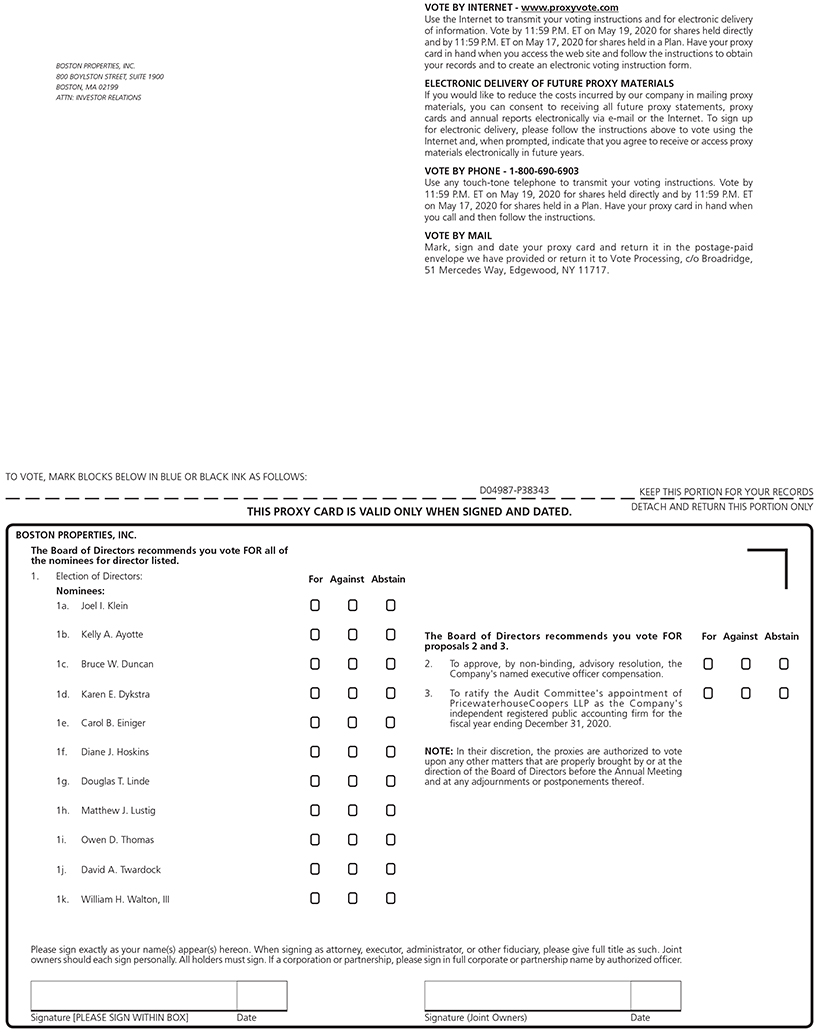

| 1. | ||||

To elect the eleven (11) nominees for director named in the proxy statement, each to serve for aone-year term and until their respective successors are duly elected and qualified. | ||||

| 2. | To hold | |||

| 3. | To ratify the Audit Committee’s appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, | |||

| 4. | To consider and act upon any other matters that are properly brought by or at the direction of the Board of Directors before the annual meeting and at any adjournments or postponements thereof. | |||

| ||||

PROXY VOTING

Whether or not you plan to attend the meeting and vote your shares of common stock in person, we urge you to vote your shares as instructed in the proxy statement. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the postage-paid envelope provided.

If your shares of common stock are held by a broker, bank or other nominee, please follow the instructions you receive from your broker, bank or other nominee to have your shares of common stock voted.

Any proxy may be revoked at any time prior to its exercise at the annual meeting.

By Order of the Board of Directors,

Frank D. Burt, ESQ.

Secretary

April 3, 2020

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be Held on May 17, 2016.20, 2020.The proxy statement and our 20152019 annual report to stockholders are available atwww.edocumentview.com/bxp.atwww.proxyvote.com.

By Order of the Board of Directors

FRANK D. BURT, ESQ.

Secretary

April 1, 2016

| | 2020 Proxy Statement |

| | 2020 Proxy Statement |

| › | PROXY SUMMARY |

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

STOCKHOLDER 2020 ANNUAL MEETING INFORMATION

| Date and Time | Location | Record Date | ||

Wednesday, May 20, 2020 9:00 a.m., Eastern Time | Metropolitan Square 655 15th Street, NW, 2nd Floor Washington, DC 20005 | March 25, 2020 |

VOTING MATTERS AND RECOMMENDATIONS

| Voting Matter | Board’s Voting Recommendation | Page Reference for more Information | ||||

Proposal 1 | Election of Eleven (11) Directors | ✓ FOR each nominee | 7 | |||

Proposal 2 | Non-binding, Advisory Vote on Named Executive | ✓ FOR | 83 | |||

| Officer Compensation | ||||||

Proposal 3 | Ratification of Appointment of Independent | ✓ FOR | 84 | |||

| Registered Public Accounting Firm | ||||||

GOVERNANCE AND COMPENSATION POLICIES AND KEY DATA

| Board Leadership | Stockholder Rights | |

• Mr. Klein serves as our independent, non-executive Chairman of the Board | • Incorporated in Delaware; the Maryland Unsolicited Takeovers Act does not apply to us • Proxy Access By-law right • Annual election of all directors • Majority voting standard in uncontested director elections • Stockholder right to amend By-laws • No Stockholder Rights Plan (or “poison pill”) • Disclosure of Policy on Company Political Spending | |

| Director Composition and Independence | ||

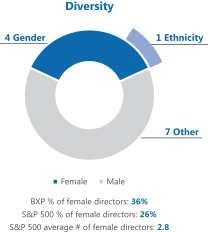

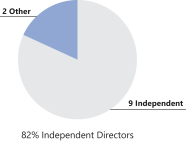

• Eleven (11) directors • Four directors are women and one director is African-American • 82% independent | ||

| Director Qualifications and Policies | Compensation | |

• Retirement age: 75-year maximum age limit at time of nomination • Regular executive sessions of independent directors • All directors and officers are subject to a Code of Business Conduct and Ethics • All directors attended 75% or more of Board and committee meetings in 2019 • Annual self-evaluation for the Board and each committee, and bi-annual interviews of individual directors by our Chairman of the Board; process overseen by our Nominating and Corporate Governance Committee | • Stock ownership requirements for executives (for CEO, 6x base salary) • Stock ownership requirements for directors (5x annual retainer) • Anti-hedging, anti-pledging and anti-short-sale policies • “Double-Trigger” vesting for time-based equity awards • Compensation Clawback Policy • Policy against tax gross-up provisions | |

| | 2020 Proxy Statement | 1 |

| › | PROXY SUMMARY |

BOARD NOMINEES

Following the recommendation of the Nominating and Corporate Governance (“NCG”) Committee, our Board of Directors has nominated the following eleven (11) candidates for election as directors at the 2020 annual meeting of stockholders.

Name | Principal Occupation | Age(1) | Director Since | Independent | Current Committee Memberships | |||||

Joel I. Klein Chairman of the Board | Chief Policy and Strategy Officer of Oscar Health Corporation | 73 | 2013 | Yes | (2) | |||||

Kelly A. Ayotte | Former United States Senator for the State of New Hampshire | 51 | 2018 | Yes | Compensation; NCG | |||||

Bruce W. Duncan(3) | Chairman and former Chief Executive Officer of First Industrial Realty Trust, Inc. | 68 | 2016 | Yes | Compensation (Chair); NCG | |||||

Karen E. Dykstra(3) | Former Chief Financial and Administrative Officer of AOL, Inc. | 61 | 2016 | Yes | Audit | |||||

Carol B. Einiger | President of Post Rock Advisors, LLC | 70 | 2004 | Yes | Compensation | |||||

Diane J. Hoskins | Chair andCo-Chief Executive Officer of M. Arthur Gensler Jr. & Associates, Inc. | 62 | 2019 | Yes | NCG | |||||

Douglas T. Linde | President of Boston Properties, Inc. | 56 | 2010 | No | ||||||

Matthew J. Lustig | Chairman of North America Investment Banking and Head of Real Estate & Lodging at Lazard Fréres & Co. | 59 | 2011 | Yes | NCG (Chair) | |||||

Owen D. Thomas | Chief Executive Officer of Boston Properties, Inc. | 58 | 2013 | No | ||||||

David A. Twardock(3) | Former President of Prudential Mortgage Capital Company, LLC | 63 | 2003 | Yes | Audit (Chair); Compensation | |||||

William H. Walton, III | Managing Member &Co-Founder of Rockpoint Group, LLC | 68 | 2019 | Yes | Audit | |||||

| (1) | Age as of May 20, 2020, the date of the annual meeting. |

| (2) | Mr. Klein serves as our independent,non-executive Chairman of the Board and as anex officio member of each of the Audit, Compensation and NCG Committees. |

| (3) | Our Board of Directors determined that each of Ms. Dykstra and Mr. Twardock qualifies as an “audit committee financial expert” as that term is defined in the rules of the Securities and Exchange Commission. Our Board of Directors has also determined that Mr. Duncan qualifies as an audit committee financial expert if he is appointed to serve on the Audit Committee in the future. |

2 |  | | 2020 Proxy Statement |

| › | PROXY SUMMARY |

SNAPSHOT OF 2020 BOARD NOMINEES

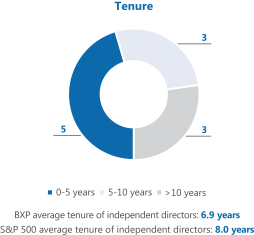

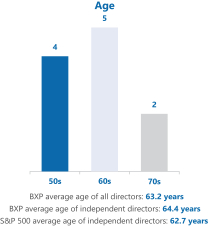

Presented below is a snapshot of the expected composition of our Board of Directors immediately following the 2020 annual meeting, assuming the election of the eleven (11) nominees named in the proxy statement. Our Board of Directors believes that, collectively, the nominees exhibit an effective mix of qualifications, experience and diversity. For comparison purposes, we have also presented comparable metrics for the constituents of the S&P 500 Index, of which Boston Properties is a member. Data for the S&P 500 Index is based on theSpencer Stuart Board Index2019.

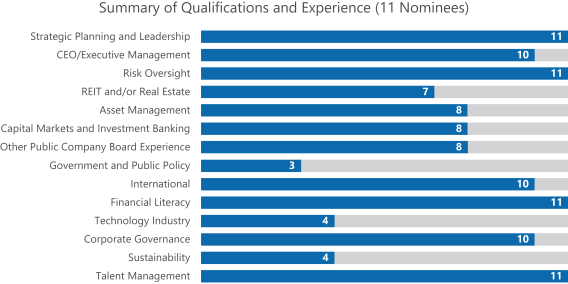

The following summarizes the qualifications and experience of the eleven (11) nominees for election as directors. For additional information, see “Proposal 1: Election of Directors – Nominees for Election” beginning on page 9 of the proxy statement.

| | 2020 Proxy Statement | 3 |

| › | PROXY SUMMARY |

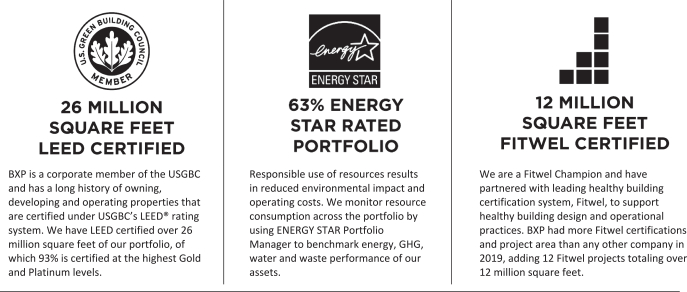

SUSTAINABILITY

The BXP sustainability strategy is to conduct our business — the development and operation of new and existing buildings — in a manner that contributes to positive economic, social and environmental outcomes for our customers, shareholders, employees and the communities we serve. Our investment philosophy is shaped by our core strategy of long-term ownership and our commitment to our communities and the centers of commerce and civic life that make them thrive. We are focused on developing and maintaining healthy, high-performance buildings, while simultaneously mitigating operational costs and the potential external impacts of energy, water, waste, greenhouse gas emissions and climate change. To that end, we have publicly adopted long-term energy, emissions, water and waste goals that establish aggressive reduction targets and have been aligned with the United Nations Sustainable Development Goals. BXP is a corporate member of the U.S. Green Building Council® (“USGBC”) and has a long history of owning, developing and operating properties that are certified under USGBC’s Leadership in Energy and Environmental Design™ (“LEED®”) rating system. In addition, we have been an active participant in the green bond market since 2018, which provides access to sustainability-focused investors interested in the positive environmental externalities of our business activities. BXP and its employees also make a social impact through charitable giving, volunteerism, public-realm investments and diversity and inclusion. Through these efforts, we demonstrate that operating and developing commercial real estate can be conducted with a conscious regard for the environment and society while mutually benefiting our stakeholders.

› INDUSTRY LEADERSHIP

We are recognized as an industry leader in sustainability as demonstrated by the following awards and achievements.

Achievements

4 |  | | 2020 Proxy Statement |

| › | PROXY SUMMARY |

Awards and Ratings

› GREEN FINANCE

In 2018 and 2019, BXP marketed and issued an aggregate of $1.85 billion of green bonds in two separate bond offerings and subsequently provided impact reporting for the first offering in 2019. Green bonds restrict the use of proceeds to eligible green projects. Eligible Green Projects are defined as: (1) building developments or redevelopments; (2) renovations in existing buildings; and (3) tenant improvement projects, in each case, that have received, or are expected to receive, in the three years prior to the issuance of the notes or during the term of the notes, a LEED Silver, Gold or Platinum certification (or environmentally equivalent successor standards). The definition of Eligible Green Projects includes the Salesforce Tower development project, which has received LEED Platinum certification, and was the project associated with BXP’s inaugural green bond offering.

| | 2020 Proxy Statement | 5 |

| › | PROXY SUMMARY |

› CLIMATE RESILIENCE

We are focused on climate preparedness and resiliency in advancement of our sustainability strategy. As a long-term owner and active manager of real estate assets in operation and under development, we strive to obtain adaptive capacity by continuing to proactively implement measures and planning and decision-making processes to protect our investments by improving resilience. We are preparing for long-term climate risk by considering climate change scenarios and will continue to assess climate change vulnerabilities resulting from potential future climate scenarios and sea level rise. Event-driven (acute) and longer-term (chronic) physical risks that may result from climate change could have a material adverse effect on our properties, operations and business. Management’s role in assessing and managing these climate-related risks and initiatives is spread across multiple teams across our organization, including our executive leadership and our Sustainability, Risk Management, Development, Construction and Property Management departments. Climate resilience measures include training and implementation of emergency response plans and the engagement of our executives and our Board of Directors on climate change and other environmental, social and governance (“ESG”) aspects.

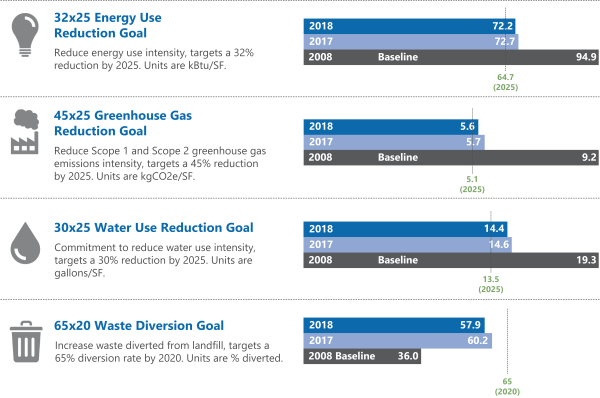

› PUBLIC SUSTAINABILITY GOALS AND PROGRESS

Our sustainability goals establish reduction targets for energy, greenhouse gas emissions, water consumption and waste. In 2016, we achieved our first round of energy, emissions and water targets three years early. By resetting company-wide goals, we raise stakeholder awareness and make best efforts to drive continuous year-over-year,like-for-like key performance indicator improvement. We have adopted goals with the following specific time frames, metrics and targets below a 2008 baseline:(1)

| (1) | Full 2019 calendar year energy and water data assured by a third party is not yet available. 2018 is the most recent year for which complete energy and water data is available and assured by a third party. |

We are committed to transparent reporting of ESG sustainability indicators. Boston Properties publishes an annual sustainability report that is aligned with the Global Reporting Initiative (“GRI”) reporting framework. More detailed sustainability information, including our strategy, key performance indicators, annuallike-for-like comparisons, achievements and historical sustainability reports are available on our website athttp://www.bxp.com under the heading “Sustainability.” Except for the documents specifically incorporated by reference into our Annual Report on Form10-K, information contained on our website or that can be accessed through our website is not incorporated by reference into our Annual Report on Form10-K.

6 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

PROXY STATEMENT

This proxy statement is being made available to stockholders of Boston Properties, Inc. (“we,” “us,” “our,” “Boston Properties” or the “Company”) on or about April 3, 2020 via the Internet or by delivering printed copies by mail, and is furnished in connection with the solicitation of proxies by the Board of Directors of Boston Properties, Inc. (our “Board” or our “Board of Directors”) for use at our 2020 annual meeting of stockholders to be held on Wednesday, May 20, 2020 at 9:00 a.m., Eastern Time, at Metropolitan Square, 655 15th Street, NW, 2nd Floor, Washington, DC 20005, and any adjournments or postponements thereof.

Depending on the status of health concerns about the coronavirus, orCOVID-19, we may decide to hold the annual meeting by live audio webcast instead of holding the meeting in person at Metropolitan Square. The Company will publicly announce a decision to hold the annual meeting, at the same date and time, solely by audio webcast in a press release available athttp://investors.bxp.com/press-releases as soon as practicable before the annual meeting. In the event the annual meeting is not held at Metropolitan Square, you or your proxyholder may participate, vote and examine our stockholder list by visitingwww.virtualshareholdermeeting.com/BXP2020 and using your16-digit control number.

Since becoming a public company in 1997, we have always held our annual meeting in person, and it remains our intention to do so under normal circumstances.

ELECTION OF DIRECTORS

Boston Properties is currently governed by an eleven-member Board of Directors. The current members of our Board of Directors are Kelly A. Ayotte, Bruce W. Duncan, Karen E. Dykstra, Carol B. Einiger, Diane J. Hoskins, Joel I. Klein, Douglas T. Linde, Matthew J. Lustig, Owen D. Thomas, David A. Twardock and William H. Walton, III. At the 2020 annual meeting of stockholders, directors will be elected to hold office for aone-year term expiring at the 2021 annual meeting of stockholders. Directors shall hold office until their successors are duly elected and qualified, or until their earlier resignation or removal. Any director appointed to our Board of Directors to fill a vacancy will hold office for a term expiring at the next annual meeting of stockholders following such appointment.

Following the recommendation of the NCG Committee, our Board of Directors nominated all directors currently serving forre-election. In making its recommendations, the NCG Committee considered a number of factors, including its criteria for Board membership, which include the minimum qualifications that must be possessed by a director candidate in order to be nominated for a position on our Board. Our Board of Directors anticipates that, if elected, the nominees will serve as directors. However, if any person nominated by our Board of Directors is unable to serve or for good cause will not serve, the proxies will be voted for the election of such other person as our Board of Directors may recommend.

VOTE REQUIRED AND MAJORITY VOTING STANDARD

OurBy-laws provide for a majority voting standard. This means that, in an uncontested election, nominees for director are elected if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. The majority voting standard would not apply in contested elections, which, generally, will include any situation in which Boston Properties receives a notice that a stockholder has nominated a person for election to our Board of Directors at a meeting of stockholders that is not withdrawn on or before the tenth day before Boston Properties first mails its notice for such meeting to the stockholders.

| | 2020 Proxy Statement | 7 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

The majority voting standard will apply to the election of directors at the 2020 annual meeting of stockholders. Accordingly, nominees for director will be elected if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Brokernon-votes, if any, and abstentions will not be treated as votes cast.

Our Board of Directors has also adopted a resignation policy, included in our Corporate Governance Guidelines, under which a director who fails to receive the required number of votes forre-election will tender his or her resignation to our Board of Directors for its consideration. The NCG Committee will then act on an expedited basis to determine whether it is advisable to accept the director’s resignation and will submit the recommendation for prompt consideration by our Board of Directors. Our Board of Directors will act on the tendered resignation within 90 days following certification of the stockholder vote and will promptly and publicly disclose its decision. The director whose resignation is under consideration will abstain from participating in any decision regarding his or her resignation. If the resignation is not accepted, the director will continue to serve until the next annual meeting of stockholders and until the director’s successor is duly elected and qualified or until the director’s earlier resignation or removal. The NCG Committee and our Board of Directors may consider any factors they deem relevant in deciding whether to accept a director’s resignation.

| ✔ | THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR EACH OF ITS NOMINEES: KELLY A. | |

8 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

The following biographical descriptions set forth certain information with respect to the nominees for election as directors at the annual meeting, based on information furnished to Boston Properties by each nominee, including the specific experience, qualifications, attributes and skills that led to the conclusion by our Board of Directors that such person should serve as a director of Boston Properties.

JOEL I. KLEIN Chief Policy and Strategy Officer of Oscar Health Corporation | Qualifications: Mr. Klein has worked for more than 40 years in private industry and government during which time he has gained significant experience in senior policy making and executive roles, as well as a broad range of legal and financial matters. Professional Background: • Chief Policy and Strategy Officer of Oscar Health Corporation, a health insurance company • Director of News Corporation since January 2011 • Executive Vice President, Office of the Chairman of News Corporation from June 2003 to December 2015 and Chief Executive Officer of Amplify, the education division of News Corporation, from January 2011 to December 2015 • Chancellor of the New York City Department of Education from 2002 through 2010, where Mr. Klein oversaw a system of over 1,600 schools with 1.1 million students, 136,000 employees and a $22 billion budget • U.S. Chairman and Chief Executive Officer of Bertelsmann, Inc. and Chief U.S. Liaison Officer to Bertelsmann AG, a media company, from 2001 to 2002 • Various roles with the Clinton administration, including Assistant U.S. Attorney General in charge of the Antitrust Division of the U.S. Department of Justice from 1997 to 2000 and Deputy White House Counsel to President Clinton from 1993 to 1995. Mr. Klein entered the Clinton administration after 20 years of public and private legal work in Washington, DC | Other Leadership Experience, Community Involvement and Education: • Member of the Boards of The Foundation for Excellence in Education (ExcelinEd) and StudentsFirstNY • Member of the Advisory Boards of the Zuckerman Mind Brain Behavior Institute and Columbia College • Received a BA magna cum laude from Columbia University and a JD magna cum laude from Harvard Law School. Mr. Klein has also received honorary degrees from ten colleges and universities | ||||

Director since: January 2013 Age:73 Independent Chairman of the Board Board Committees: •ex officio member of all committees Other Public Company Boards: • Current: News Corporation • Former (past 5 years): None |

| | 2020 Proxy Statement | 9 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

SENATOR KELLY A. AYOTTE Former U.S. Senator for the State of New Hampshire | Qualifications: Senator Ayotte has significant legal experience and experience in government and public affairs, as well as leadership and strategic planning skills. Professional Business Experience: • Represented New Hampshire in the United States Senate from 2011 to 2016; chaired the Armed Services Subcommittee on Readiness and the Commerce Subcommittee on Aviation Operations; and served on the Budget, Homeland Security and Governmental Affairs, Small Business and Entrepreneurship, and Aging Committees • New Hampshire’s first female Attorney General from 2004 to 2009 appointed by Republican Governor Craig Benson and reappointed twice by Democratic Governor John Lynch • Previously Deputy Attorney General, Chief of the Homicide Prosecution Unit and Legal Counsel to Governor Craig Benson • Former associate at the McLane Middleton law firm and law clerk to the New Hampshire Supreme Court • Director of The Blackstone Group, Inc., Caterpillar Inc. and News Corporation • Director of Blink Health LLC and BAE Systems, Inc., each a private company • Former director of Bloom Energy Corporation from 2017 to 2019 • Member of advisory boards of Microsoft Corporation, Chubb Insurance and Cirtronics Corporation | Other Leadership Experience, Community Involvement and Education: • Senior Advisor for Citizens for Responsible Energy Solutions • Member ofnon-profit boards of the One Campaign, the International Republican Institute, the McCain Institute, Swim with a Mission, Winning for Women and Veterans Count of New Hampshire • Member of the Aspen Institute’s Economic Strategy • Member of Board of Advisors for the Center on Military and Political Power at the Foundation for Defense of Democracies • Co-chair of the Center for Strategic and International Study’s Commission on Health Security • Co-chair of the Center for a New American Security’s Digital Freedom Forum • Graduated with honors from the Pennsylvania State University and received a JD from the Villanova University School of Law | ||||

Director since:May 2018 Age:51 Independent Board Committees: • Compensation • NCG Other Public Company Boards: • Current: The Blackstone Group, Inc., Caterpillar Inc., News Corporation • Former (past 5 years): Bloom Energy Corporation |

10 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

BRUCE W. DUNCAN Chairman of the Board of Directors of First Industrial Realty Trust, Inc. | Qualifications: Mr. Duncan has more than 30 years of diverse real estate management and investment experience, including as a chief executive officer and a director of other publicly traded companies. Professional Business Experience: • Chairman of the Board of Directors of First Industrial Realty Trust, Inc. (“First Industrial”), an industrial real estate investment trust (“REIT”), since January 2016, and a director of First Industrial since January 2009; President and Chief Executive Officer of First Industrial from January 2009 until he stepped down as President in September 2016 and retired as Chief Executive Officer in November 2016 • Senior advisor to Kohlberg Kravis Roberts & Co. (“KKR”), a global investment firm, since November 2018; previously senior advisor to KKR from July 2008 to January 2009 • Former Chairman of the Board of Directors of Starwood Hotels & Resorts Worldwide, Inc. (“Starwood”), a leading worldwide hotel and leisure company, from May 2005 until its acquisition by Marriott International, Inc. in September 2016; director of Starwood from 1999 to September 2016; interim Chief Executive Officer of Starwood from April 2007 to September 2007 • Trustee of Starwood Hotels & Resorts, a REIT and former subsidiary of Starwood, from 1995 to 2006 • Director of Marriott International, Inc., the world’s largest hotel company, since September 2016, and T. Rowe Price Mutual Funds since September 2013 • Private investor from January 2006 to January 2009 • Various positions at Equity Residential, one of the largest publicly traded apartment REITs in the United States, from March 2002 to December 2005, including Chief Executive Officer and Trustee from May 2005 to December 2005, President, Chief Executive Officer and Trustee from January 2003 to May 2005, and President and Trustee from March 2002 to December 2002 • Former director of The Rouse Company, a diversified commercial real estate firm • Chairman, President and Chief Executive Officer of Cadillac Fairview Corporation, one of North America’s largest owners and developers of retail and office properties, from December 1995 to March 2000 | Other Leadership Experience, Community Involvement and Education: • Life Trustee of Rush University Medical Center in Chicago • Former member of the Advisory Board of Governors of the National Association of Real Estate Investment Trusts (“Nareit”) and the Executive Committees of the Board of the Canadian Institute for Public Real Estate Companies (CIPREC) and the National Multi-Housing Council (NMHC) • Former trustee of the International Council of Shopping Centers (ICSC) • Received a BA in Economics from Kenyon College and an MBA in Finance from the University of Chicago | ||||

Director since:May 2016 Age:68 Independent Board Committees: • Compensation (Chair) • NCG Other Public Company Boards: • Current: First Industrial Realty Trust, Inc., Marriott International, Inc. • Former (past 5 years): Starwood Hotels & Resorts Worldwide, Inc. |

| | 2020 Proxy Statement | 11 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

KAREN E. DYKSTRA Former Chief Financial and Administrative Officer of AOL, Inc. | Qualifications: Ms. Dykstra has extensive strategic, management, financial, accounting and oversight experience, particularly with companies in the technology sector. Professional Business Experience: • Chief Financial and Administrative Officer of AOL, Inc., a global media technology company, from November 2013 to July 2015; Chief Financial Officer of AOL, Inc. from September 2012 to November 2013 • Partner of Plainfield Asset Management LLC (“Plainfield”) from January 2007 to December 2010 • Chief Operating Officer and Chief Financial Officer of Plainfield Direct Inc., Plainfield’s business development company, from May 2006 to 2010 and a director from 2007 to 2010 • Various positions with Automatic Data Processing, Inc. for over 25 years, including serving most recently as Chief Financial Officer from January 2003 to May 2006, and as Vice President – Finance, Corporate Controller • Director of Sirius Computer Solutions, a private company • Director of Gartner, Inc. since 2007 and VMware, Inc. since March 2016 • Former director of Crane Co. from 2004 to 2012 and AOL, Inc. from 2009 to 2012 | Education: • Received a BA in Accounting from Rider University and an MBA from Fairleigh Dickinson University | ||||

Director since:May 2016 Age:61 Independent Board Committees: • Audit Other Public Company Boards: • Current: Gartner, Inc., VMware, Inc. • Former (past 5 years): None |

12 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

CAROL B. EINIGER President of Post Rock Advisors, LLC | Qualifications: Ms. Einiger has more than 40 years of experience as an investment banker and investment advisor, during which time she has gained significant expertise in the operation of public and private debt and equity capital markets and the evaluation of investment opportunities. Professional Background: • President of Post Rock Advisors, LLC, a private investment firm, since July 2018; founder and President of Post Rock Advisors, LLC from 2005 to 2016 • Senior Advisor of Roundtable Investment Partners LLC, a registered investment advisory firm, from January 2017 to June 2018 • Chief Investment Officer of The Rockefeller University, where Ms. Einiger was responsible for the management of the University’s endowment, from 1996 to 2005 • Chief Financial Officer and then Acting President of the Edna McConnell Clark Foundation from 1992 to 1996 • Managing Director at Wasserstein Perella & Co. from 1989 to 1992 • Visiting Professor andExecutive-in-Residence at Columbia Business School from 1988 to 1989 • Various positions at The First Boston Corporation from 1973 to 1988, becoming Managing Director and Head of the Capital Markets Department • Various positions at Goldman, Sachs & Co. from 1971 to 1972 | Other Leadership Experience, Community Involvement and Education: • Director, member and former Chair of the Investment Committee ofUJA-Federation of New York • Member of the Investment Committee of the JPB Foundation and the Board of Overseers of Columbia Business School • Former member of the Boards of Trustees and Investment Committees of the University of Pennsylvania, the Lasker Foundation, the Horace Mann School • Former member of the Advisory Board of Blackstone Alternative Asset Management • Former Vice Chair of the Investment Committee of The Museum of Modern Art • Former Director of Credit Suisse First Boston (USA) and The New York Stem Cell Foundation • Recipient of numerous awards, including the Alumni Award of Merit of the University of Pennsylvania, the Columbia Business School Distinguished Alumna Award, the AJC National Human Relations Award, the Anti-Defamation League Woman of Achievement Award and the Catalyst Award for Corporate Leadership • Received a BA from the University of Pennsylvania and an MBA with honors from Columbia Business School | ||||

Director since:May 2004 Age:70 Independent Board Committees: • Compensation Other Public Company Boards: • Current: None • Former (past 5 years): None |

| | 2020 Proxy Statement | 13 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

DIANE J. HOSKINS Co-CEO and Chair of M. Arthur Gensler Jr. & Associates, Inc. | Qualifications: Ms. Hoskins has more than 30 years of architecture, design, real estate and business experience, including as a chief executive officer of a global brand. During this time, she has gained extensive leadership, strategic planning, and organizational development experience, as well as a deep understanding of markets and clients, including their current and future space needs and insight into how companies envision their work spaces of the future. Professional Background: • Co-CEO of M. Arthur Gensler Jr. & Associates, Inc. (“Gensler”), the world’s largest architecture, design, and planning firm since 2005, and Chair of the Gensler Board of Directors since 2018, where Ms. Hoskins has broad responsibility for managing Gensler, overseeing the company’s global platform and itsday-to-day operations, which spans over 6,000 employees networked across 48 offices in the Americas, Europe, Asia, and the Middle East • Various positions at Gensler since 1995, including Southeast Regional Managing Principal and Managing Director of the Washington, DC office • Founded the Gensler Research Institute to generate new knowledge and develop a deeper understanding of the connection between design, business, and the human experience • Senior Vice President of Epstein Architecture and Engineering from 1990 to 1994 • Development Analyst at Olympia & York from 1987 to 1990 • Architect Designer at Gensler from 1983 to 1985 • Architect at Skidmore Owings & Merrill from 1980 to 1983 | Other Leadership Experience, Community Involvement and Education: • Member of the World Economic Forum’s Global Future Council on Cities & Urbanization and the CEO Initiative by Fortune and Time • Fellow of the American Institute of Architects and member of several organizations, including the D.C. Board of Trade and the Economic Club of Washington, DC • Serves on the Visiting Committee of the School of Architecture at the Massachusetts Institute of Technology (MIT) and the Board of Advisors of the University of California, Los Angeles (UCLA) Anderson School of Management • Ms. Hoskins has been honored by several organizations for her work, including the Spirit of Life Award from City of Hope and the Outstanding Impact Award from the Council of Real Estate Women • Inducted into the Washington Business Hall of Fame in 2016, and, along with herCo-CEO, were ranked on the Business Insider’s 100 “Creators” list, a who’s who of the world’s 100 top creative visionaries • Ms. Hoskins is sought after by the media to share her expertise in many top tier media outlets, including The New York Times, Harvard Business Review, Fortune, Financial Times, Bloomberg TV, and global architecture and design trade publications • Frequent speaker at premier conferences, including the Bloomberg Business/CEO Summit, the Economist Human Potential Conference, and the Wall Street Journal Future of Cities Conference; was a featured panelist at the UN Climate Summit in the fall of 2019 • Graduated from MIT and holds an MBA from the Anderson Graduate School of Management at UCLA | ||||

Director since: May 2019 Age:62 Independent Board Committees: • NCG Other Public Company Boards: • Current: None • Former (past 5 years): None |

14 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

DOUGLAS T. LINDE President of Boston Properties, Inc. | Qualifications: Mr. Linde has more than 30 years of experience in the real estate industry, including as our President and former Chief Financial Officer, during which time he gained extensive knowledge of the real estate industry, capital markets and real estate finance, as well as substantial experience in transactional, operational and accounting matters. Professional Background: • President of Boston Properties, Inc. since May 2007 • Mr. Linde joined Boston Properties in January 1997 as Vice President of Acquisitions and New Business to help identify and execute acquisitions and to develop new business opportunities and served as Senior Vice President for Financial and Capital Markets from October 1998 to January 2005, Chief Financial Officer and Treasurer from September 2000 to November 2007, and Executive Vice President from January 2005 to May 2007 • President of Capstone Investments, a Boston real estate investment company, from 1993 to 1997 • Project Manager and Assistant to the Chief Financial Officer of Wright Runstad and Company, a private real estate developer in Seattle, WA, from 1989 to 1993 • Began his career in the real estate industry with Salomon Brothers’ Real Estate Finance Group | Other Leadership Experience, Community Involvement and Education: • Trustee of the Beth Israel Lahey Health Board of Trustees • Director Emeritus of the Board of Directors of Beth Israel Deaconess Medical Center (“BIDMC”) andco-chair of the BIDMC capital campaign • Member of the Real Estate Roundtable • Director of the Boston Municipal Research Bureau and Jobs for Massachusetts • Member of the Urban Studies and Planning Visiting Committee at MIT and the Wesleyan University Board of Trustees • Received a BA from Wesleyan University and an MBA from Harvard Business School | ||||

Director since:January 2010 Age:56 Other Public Company Boards: • Current: None • Former (past 5 years): None |

| | 2020 Proxy Statement | 15 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

MATTHEW J. LUSTIG Chairman of North America Investment Banking and Head of Real Estate and Lodging at Lazard Fréres & Co. | Qualifications: Mr. Lustig has worked for more than 35 years in the real estate industry, during which time he has gained extensive experience providing strategic and financial advice and transaction execution to clients including leading real estate companies, and investing in real estate companies and assets as a principal. Professional Background: • Chairman of North America Investment Banking at Lazard Frères & Co. (“Lazard”), the investment bank, since 2019 (previously Head of North America Investment Banking, from 2012 to 2019), with responsibility for the management of a range of Financial Advisory/Investment Banking businesses • Head of Real Estate & Lodging at Lazard, a position he has held for more than 20 years, serving clients and running its Real Estate and Lodging industry group. In recent years, Mr. Lustig has played an active role in more than $300 billion of advisory assignments and transactions involving leading real estate and lodging companies in the public and private markets • Former Chief Executive Officer of the real estate investment business of Lazard and its successors, where he oversaw multiple funds with over $2.5 billion of equity capital invested in REITs and real estate operating companies • Director of Ventas, Inc., a REIT with a portfolio of senior housing, research and innovation, and healthcare properties, since May 2011 • Former Chairman of Atria Senior Living Group, Inc., which was acquired by Ventas in May 2011 • Former director of several other public and private fund portfolio REITs and companies | Other Leadership Experience, Community Involvement and Education: • Member of the Real Estate Roundtable, the Urban Land Institute, the Pension Real Estate Association (former Board and Executive Committee member) and the Council on Foreign Relations • Member of the Real Estate centers at the business schools of Wharton/UPenn (Chairman of the Advisory Board) and Columbia University • Member of the Board of Advisors at the School of Foreign Service at Georgetown University • Received a BSFS from Georgetown University | ||||

Director since:January 2011 Age:59 Independent Board Committees: • NCG (Chair) Other Public Company Boards: • Current: Ventas, Inc. • Former (past 5 years): None |

16 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

OWEN D. THOMAS Chief Executive Officer of Boston Properties, Inc. | Qualifications: Mr. Thomas is a recognized leader in the real estate industry with more than 33 years of executive leadership, strategic planning and management experience, as well as substantial experience in financial and capital markets. Professional Background: • Chief Executive Officer of Boston Properties, Inc. since April 2013 • Chairman of the Board of Directors of Lehman Brothers Holdings Inc. (“LBHI”) from March 2012 until March 2013 and continues to serve as a member of the Board of Directors of LBHI • Various positions at Morgan Stanley from 1987 to 2011, including Chief Executive Officer of Morgan Stanley Asia Ltd., President of Morgan Stanley Investment Management, Head of Morgan Stanley Real Estate and Managing Director • Member of Morgan Stanley’s Management Committee from 2005 to 2011 | Other Leadership Experience, Community Involvement and Education: • Global Chairman of the Urban Land Institute • Director of the Real Estate Roundtable • Member of the Executive Board of Nareit • Received a BS in Mechanical Engineering from the University of Virginia and an MBA from Harvard Business School | ||||

Director since:April 2013 Age:58 Other Public Company Boards: • Current: None • Former (past 5 years): None |

| | 2020 Proxy Statement | 17 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

DAVID A. TWARDOCK Former President of Prudential Mortgage Capital Company, LLC | Qualifications: Mr. Twardock has more than 30 years of experience in the real estate finance industry, during which time he has overseen the lending and asset management of billions of dollars of commercial mortgages and other real estate debt financing and the management and disposition of billions of dollars of real estate equity. Professional Background: • Former President of Prudential Mortgage Capital Company, LLC, the real estate finance affiliate of Prudential Financial, Inc., from December 1998 to March 2013, which had more than $70 billion in assets under management and administration as of December 31, 2012 and annually lent billions of dollars in real estate debt financing • Various positions with Prudential relating to real estate equity and debt from 1982 to December 1998, including as Senior Managing Director of Prudential Realty Group from 1996 to November 1998 • Member of the advisory boards of Blue Vista Capital Management and LBA Realty • Director of Morgan Stanley Bank, N.A. from 2015 through 2018 | Other Leadership Experience, Community Involvement and Education: • Member of the Urban Land Institute and the Economics Club of Chicago • Former director of the Real Estate Roundtable and former Chairman of the Real Estate Roundtable Capital Markets Committee • Received a BS in Civil Engineering from the University of Illinois and an MBA in Finance and Behavioral Science from the University of Chicago | ||||

Director since:May 2003 Age:63 Board Committees: • Audit (Chair) • Compensation Other Public Company Boards: • Current: None • Former (past 5 years): None |

18 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

WILLIAM H. WALTON, III Co-Founder and Managing Member of Rockpoint Group, LLC | Qualifications: Mr. Walton has 40 years of real estate investment, development and management experience, as well as executive leadership experience having served in various roles and as a director of several public and private companies. Professional Background: • Co-founder and managing member of Rockpoint Group, LLC (“Rockpoint”), a global real estate investment management firm, where Mr. Walton is responsible for the overall operations and management of Rockpoint, as well as overseeing the origination, structuring and asset management of all of Rockpoint’s investment activities; since 1994, the Rockpoint founding managing members have invested in approximately $60 billion of real estate • Co-founder of Westbrook Real Estate Partners, LLC (“Westbrook”), a real estate investment management firm • Managing director in the real estate group of Morgan Stanley & Co., Inc. prior toco-founding Westbrook • Director of Crow Holdings, a privately owned real estate and investment firm, and FRP Holdings, Inc., a company engaged in the real estate business • Former trustee of Corporate Office Properties Trust and former director of Florida Rock Industries and The St. Joe Company | Other Leadership Experience, Community Involvement and Education: • Involved with several real estate industry organizations • Director or trustee of severalnon-profit organizations, with a particular interest in educational and policy entities, including the American Enterprise Institute, the Jacksonville University Public Policy Institute, KIPP Jacksonville Schools, Mpala Wildlife Foundation and the University of Florida Investment Corporation • Former member of the boards of Communities in Schools, the Episcopal School of Jacksonville, Princeton University and Princeton University Investment Company • Received an AB from Princeton University and an MBA from Harvard Business School | ||||

Director since:May 2019 Age:68 Board Committees: • Audit Other Public Company Boards: • Current: FRP Holdings, Inc. • Former (past 5 years): None |

| | 2020 Proxy Statement | 19 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

› SUMMARY OF BOARD NOMINEE QUALIFICATIONS, EXPERIENCE AND DIVERSITY

In addition to the minimum qualifications that our Board of Directors believes are necessary for all directors, the following chart highlights certain qualifications and experience that are relevant to our long-term strategy and therefore relevant when considering candidates for election to our Board. A mark for an attribute indicates that the nominee gained the attribute through a current or prior position other than his or her service on the Boston Properties Board of Directors. Our Board did not assign specific weights to any of these attributes or otherwise formally rate the level of a nominee’s attribute relative to the rating for any other potential nominee. The absence of a mark for an attribute does not necessarily mean that the nominee does not possess that attribute; it means only that when the Board considered that nominee in the overall context of the composition of our Board of Directors, that attribute was not a key factor in the determination to nominate that individual. Further information on each nominee’s qualifications and relevant experience is provided in the individual biographical descriptions above.

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Qualification/Experience | Ayotte | Duncan | Dykstra | Einiger | Hoskins | Klein | Linde | Lustig | Thomas | Twardock | Walton | |||||||||||||||||||

Strategic Planning | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||||||||

CEO/Executive Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||||||||||

Risk Oversight | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||||||||

REITs/Real Estate | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||||||||||||

Asset Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||||||||||

Capital Markets/ | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||||||||||

Other Public Company | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||||||||||

Government/Public Policy | 🌑 | 🌑 | 🌑 | |||||||||||||||||||||||||||

International | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||||||||

Financial Literacy | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||||||||

Technology Industry | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||||||||||||||

Corporate Governance | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||||||||

Sustainability | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||||||||||||||

Talent Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||||||||

BOARD COMPOSITION | ||||||||

| 9 of 11 | 7.2 years | 63.2 years | 4 | 1 | ||||

Independent Directors | Average Tenure of all Nominees | Average Age of all Nominees | Women | Ethnic Minority | ||||

20 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

Under the rules of the New York Stock Exchange (the “NYSE”), a majority of the Board of Directors must qualify as “independent directors.” To qualify as an “independent director,” the Board of Directors must affirmatively determine that the director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). Our Board of Directors established categorical standards to assist it in making the required independence determinations.

Under these categorical standards, any relationship with us shall be deemed not material if:

| 1. | The relationship does not preclude a finding of independence under Sections 303A.02(b) of the NYSE Listed Company Manual (the “NYSE Disqualifying Rules”); and |

| 2. | The relationship does not involve any of the following, whether currently existing or occurring since the end of the last fiscal year or during the past three fiscal years: |

| (a) | a director being an executive officer of, or owning, or having owned, of record or beneficially in excess of ten percent (10%) equity interest in, any business or professional entity that has made during any of such fiscal years, or proposes to make during the Company’s current fiscal year, payments to the Company, an executive officer of the Company or an entity controlled by an executive officer of the Company for property or services in excess of five percent (5%) of: (i) the Company’s consolidated gross revenues for such fiscal year (or, in the case of proposed payments, its last fiscal year), or (ii) the other entity’s consolidated gross revenues for such fiscal year (or, in the case of proposed payments, its last fiscal year); |

| (b) | a director being an executive officer of, or owning, or having owned, of record or beneficially in excess of ten percent (10%) equity interest in, any business or professional entity to which the Company, an executive officer of the Company or an entity controlled by an executive officer of the Company has made during any of such fiscal years, or proposes to make during the Company’s current fiscal year, payments for property or services in excess of five percent (5%) of: (i) the Company’s consolidated gross revenues for such fiscal year (or, in the case of proposed payments, its last fiscal year), or (ii) the other entity’s consolidated gross revenues for such fiscal year (or, in the case of proposed payments, its last fiscal year); |

| (c) | a director or an immediate family member of the director being an officer, director or trustee of a charitable organization where the annual discretionary charitable contributions of the Company, an executive officer of the Company or an entity controlled by an executive officer of the Company in any single year to the charitable organization exceeded the greater of $1 million or two percent (2%) of that organization’s consolidated gross revenues for the fiscal year; |

| (d) | a director or an immediate family member of a director being indebted to the Company, an executive officer of the Company or an entity controlled by an executive officer of the Company in an amount in excess of $120,000; |

| (e) | a director being an executive officer, partner or greater than 10% equity owner of an entity, or being a trustee or a substantial beneficiary of a trust or estate, indebted to the Company, an executive officer of the Company or an entity controlled by an executive officer of the Company in an amount in excess of the greater of $120,000 or 5% of such entity’s total consolidated assets, or to whom the Company or an entity controlled by an executive officer of the Company is indebted (other than with respect to (i) any publicly traded debt securities of the Company or such entity or(ii) non-recourse loans secured by real estate where both the lender and the Company or such entity intend for the lender to transfer all right to, and control over, the loan within 12 months and the documentation includes customary provisions for loans targeted at the commercial mortgage backed securities (CMBS) or collateralized debt obligation (CDO) markets) in an amount in excess of 5% of the Company’s or such entity’s total consolidated assets; |

| (f) | a transaction or currently proposed transaction (other than relating to the ownership of securities), which involved or involves the direct or indirect payment in a single year of in excess of $120,000 from the Company, an executive officer of the Company or an entity controlled by an executive officer of the Company to a director or an immediate family member of a director; |

| | 2020 Proxy Statement | 21 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

| (g) | a director or an immediate family member of a director being an executive officer, general or managing partner or owner of more than 10% of the outstanding equity securities of an entity that has aco-investment or is a joint venture partner with the Company where the amount of the entity’s equity investment in any single year exceeds the greater of $1 million or 2% of the total consolidated assets of the entity; or |

| (h) | a director or an immediate family member of a director being an executive officer, general or managing partner or owner of more than 10% of the outstanding equity securities of an entity (other than the Company) in which an executive officer of the Company or an entity controlled by an executive officer of the Company is an executive officer, general or managing partner or owner of more than 10% of the outstanding equity securities of the entity. |

For purposes of these standards, “immediate family” member has the same meaning as in the NYSE Disqualifying Rules.

Relationships not specifically deemed not material by the above categorical standards may, in the Board’s judgment, be deemed not to be material.

› 2020 INDEPENDENCE DETERMINATIONS

The Board of Directors concluded that the following directors qualify as independent directors under NYSE rules because none of them (1) has any relationships that would disqualify him or her from being considered independent under the minimum objective standards contained in the NYSE rules or (2) has any relationships other than those deemed to be immaterial under the categorical standards adopted by the Board of Directors.

› Kelly A. Ayotte › Bruce W. Duncan › Karen E. Dykstra | › Carol B. Einiger › Diane J. Hoskins › Joel I. Klein | › Matthew J. Lustig › David A. Twardock › William H. Walton, III |  | |||

In determining that each of Ms. Ayotte and Messrs. Duncan and Twardock qualified as an independent director for purposes of his or her service on the Compensation Committee, our Board considered that (1) each serves or previously served as anon-employee director for a company with which Boston Properties has a commercial relationship and engaged in transactions in the ordinary course of business, (2) each transaction was on arms’-length terms and the director had no direct or indirect involvement in the transaction, and (3) the director had no pecuniary interest in the success of the transaction.

CONSIDERATION OF DIRECTOR NOMINEES

› SECURITYHOLDER RECOMMENDATIONS

The NCG Committee’s current policy is to review and consider any director candidates who have been recommended by securityholders in compliance with the procedures established from time to time by the NCG Committee. All securityholder recommendations for director candidates must be submitted to our Secretary at Boston Properties, Inc., 800 Boylston Street, Suite 1900, Boston, Massachusetts 02199-8103, who will forward all recommendations to the NCG Committee. We did not receive any securityholder recommendations for director candidates for election at the 2020 annual meeting in compliance with the procedures set forth below. All securityholder recommendations for director candidates for election at the 2021 annual meeting of stockholders must be submitted to our Secretary on or before December 4, 2020 and must include the following information:

the name and address of record of the securityholder;

a representation that the securityholder is a record holder of our securities, or if the securityholder is not a record holder, evidence of ownership in accordance with Rule14a-8(b)(2) under the Securities Exchange Act of 1934;

22 |  | | 2020 Proxy Statement |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding five (5) full fiscal years of the proposed director candidate;

a description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications and other criteria for Board membership as approved by the Board from time to time;

a description of all arrangements or understandings between the securityholder and the proposed director candidate;

the consent of the proposed director candidate (1) to be named in the proxy statement relating to our annual meeting of stockholders and (2) to serve as a director if elected at such annual meeting; and

any other information regarding the proposed director candidate that is required to be included in a proxy statement filed pursuant to the rules of the Securities and Exchange Commission (“SEC”).

› BOARD MEMBERSHIP CRITERIA

The NCG Committee has established criteria for NCG Committee-recommended director nominees. These criteria include the following specific, minimum qualifications that the NCG Committee believes must be met by an NCG Committee-recommended nominee for a position on the Board:

the candidate must have experience at a strategic or policymaking level in a business, government,non-profit or academic organization of high standing;

the candidate must be highly accomplished in his or her respective field, with superior credentials and recognition;

the candidate must be well regarded in the community and must have a long-term reputation for high ethical and moral standards;

the candidate must have sufficient time and availability to devote to our affairs, particularly in light of the number of boards on which the candidate may serve;

the candidate’s principal business or occupation must not be such as to place the candidate in competition with us or conflict with the discharge of a director’s responsibilities to us and our stockholders; and

to the extent the candidate serves or has previously served on other boards, the candidate must have a history of actively contributing at board meetings.

In addition to the minimum qualifications for each nominee set forth above, the NCG Committee will recommend director candidates to the full Board for nomination, or present director candidates to the full Board for consideration, to help ensure that:

a majority of the Board of Directors will be “independent” as defined by the NYSE rules;

each of its Audit, Compensation and NCG Committees will be comprised entirely of independent directors; and

at least one member of the Audit Committee will have such experience, education and other qualifications necessary to qualify as an “audit committee financial expert” as defined by the rules of the SEC.

Finally, in addition to any other standards the NCG Committee may deem appropriate from time to time for the overall structure and composition of the Board, the NCG Committee may consider the following factors when recommending director candidates to the full Board for nomination, or presenting director candidates to the full Board for consideration:

whether the candidate has direct experience in the real estate industry or in the markets in which we operate; and

whether the candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience.

› IDENTIFYING AND EVALUATING NOMINEES

The NCG Committee may solicit recommendations for director nominees from any or all of the following sources:non-management directors, the Chief Executive Officer, other executive officers, third-party search firms or any other source it deems appropriate.

| | 2020 Proxy Statement | 23 |

| 1› | PROPOSAL 1: ELECTION OF DIRECTORS |

The NCG Committee will review and evaluate the qualifications of any proposed director candidate that it is considering or has been recommended to it by a securityholder in compliance with the NCG Committee’s procedures for that purpose, and conduct inquiries it deems appropriate into the background of these proposed director candidates. In identifying and evaluating proposed director candidates, the NCG Committee may consider, in addition to the minimum qualifications for NCGCommittee-recommended director nominees, all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the proposed director candidate, his or her depth and breadth of business experience, his or her independence and the needs of our Board. Neither the NCG Committee nor the Board has a specific policy with regard to the consideration of diversity in identifying director nominees, although both may consider diversity when identifying and evaluating proposed director candidates. As noted above, the NCG Committee, when recommending director candidates to the full Board for nomination, may consider whether a director candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience. Other than circumstances in which we may be legally required by contract or otherwise to provide third parties with the ability to nominate directors, the NCG Committee will evaluate all proposed director candidates that it considers or who have been properly recommended to it by a securityholder based on the same criteria and in substantially the same manner, with no regard to the source of the initial recommendation of the proposed director candidate.

24 |  | | 2020 Proxy Statement |

| 2› | CORPORATE GOVERNANCE |

CORPORATE GOVERNANCE HIGHLIGHTS

Boston Properties is committed to strong corporate governance policies, practices, and procedures designed to make the Board Leadership Transition; Chairman Emerituseffective in exercising its oversight role. Our Board of Directors oversees management performance on behalf of our stockholders to ensure that the long-term interests of our stockholders are being served, to monitor adherence to Boston Properties standards’ and policies, and to promote the exercise of responsible corporate citizenship. Our Board values and considers the feedback we receive from our stockholders, and we have taken a number of actions over the last several years to increase stockholder rights, enhance the Board’s structure, and augment our commitment to sustainability and corporate responsibility taking into account those perspectives.

Following a deliberate and structured process,BOARD LEADERSHIP STRUCTURE

Our Corporate Governance Guidelines provide that our Board of Directors will undergo an orderly transitiondoes not have a policy with respect to whether or not the role of Chairman of the Board and CEO should be separate or combined. However, our Board has determined that its leadership atstructure should include either an independent,non-executive Chairman of the 2016 annual meetingBoard or a lead independent director who satisfies our standards for independence. Accordingly, our Corporate Governance Guidelines provide that it is the Board’s policy that if (1) the positions of stockholders. Mr. Mortimer B. Zuckerman, who co-founded Boston PropertiesChairman of the Board and CEO are held by the same person, (2) the position of Chairman of the Board is held by anon-independent director or (3) none of the directors has been elected to serve as Chairman of the Board, then the independent directors shall select an independent director to serve as lead independent director.

When our Board of Directors amended our Corporate Governance Guidelines in 1970 and has served2014 to create the position of lead independent director, the Board contemplated that in the future it might determine that it is advisable to appoint an independent,non-executive Chairman of the Board. As a result, our Corporate Governance Guidelines provide that an independent director selected to serve as lead independent director will serve in that role until (1) he or she ceases to be an independent director or resigns from the position, (2) a successor is selected by a majority of the independent directors or (3) an independent director is serving as the Chairman of the Board. In addition, if the Chairman of the Board is an independent director, then the Chairman of the Board shall assume the responsibilities of the lead independent director referenced above and there will not be a separate lead independent director.